Saving money has never been more important for American households. Rising inflation, high living costs, and increasing debt push families and individuals to find creative ways to manage their finances. One of the most popular methods in recent years is the no spend challenge, a trend that has gone viral across the US. Alongside it, other money saving challenges like the 52-week challenge and envelope challenge help thousands of people build stronger financial habits.

This article explores the top money saving challenges that actually work in the US, focusing especially on the no spend challenge, why it works, and how you can use it to achieve your financial goals.

What Is a No Spend Challenge ?

A no-spend challenge is a personal finance strategy where you commit to avoiding all non essential spending for a set period of time. Essentials such as rent, mortgage, groceries, utilities, and transportation are allowed, but everything else like dining out, entertainment, clothing, or impulse shopping is cut out completely.

The idea is simple but powerful: by saying “no” to unnecessary expenses, you build awareness of your financial habits and redirect that money into savings, debt repayment, or investments. In the US, many people try a no-spend week or month, while others push themselves to go even longer.

How to Start a No Spend Challenge

If you are new to the no-spend challenge, here are simple steps to get started:

1. Choose Your Timeframe – Decide whether you want to commit for 7 days, 14 days, or a full 30-day month.

2. Define Essential Spending – List only the items you absolutely need such as bills, groceries, and transportation.

3. Cut Out Non-Essentials – Coffee runs, takeout meals, clothing, subscriptions, and online shopping should be paused.

4. Find Free Alternatives – Replace expensive habits with free or low cost activities like home workouts, cooking at home, or borrowing books from the library.

5. Track Your Progress – Use a notebook, calendar, or budgeting app to monitor your no-spend days.

6. Reward Yourself the Smart Way – Instead of splurging after the challenge, transfer the saved money directly to your savings account.

Benefits of a No Spend Challenge

The no-spend challenge goes beyond short term savings. It creates lasting financial awareness and discipline.

• Instant savings: You immediately stop unnecessary spending.

• Better financial control: You learn to separate needs from wants.

• Debt reduction: The money you save can pay off credit cards or loans.

• Long-term habits: It encourages mindful shopping and conscious consumption.

• Impro ed lifestyle: Less eating out and impulsive shopping often lead to healthier living.

For many Americans, even a short no-spend period reveals how much money disappears on habits like coffee shops, fast food, or online shopping.

Other Popular Money Saving Challenges in the US

- 52-Week Money Challenge

This challenge starts small and grows every week. Save $1 in week one, $2 in week two, and so on until week 52. By the end of the year, you will have $1,378 saved. It’s a beginner-friendly challenge that helps people gradually build a savings habit.

- Envelope Challenge

This traditional method uses 100 envelopes labeled with amounts from $1 to $100. Each week, you pick an envelope and save the amount written on it. By the end, you will have saved $5,050. This challenge is popular among people who prefer physical, visual ways to save.

- Round-Up Challenge

Every time you make a purchase, you round up to the nearest dollar and put the difference into a savings account. For example, if you spend $8.40, you round it to $9 and save the extra $0.60. Many US banks and apps automate this process.

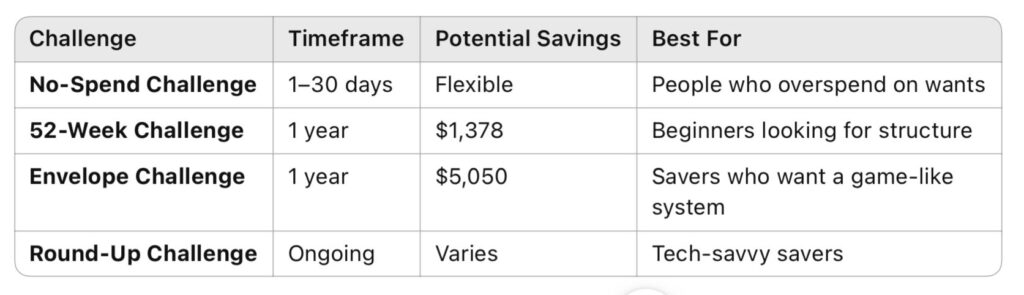

Comparison of Money Saving Challenges

Why the No-Spend Challenge Works Best in the US

While all challenges can help build savings, the no spend challenge is often considered the most effective in the US. Unlike gradual methods, it delivers immediate results. By forcing a pause on spending, it helps people reset their financial habits, cut debt faster, and save money that would otherwise be wasted.

Social media platforms like TikTok and Instagram have made the no spend challenge even more popular, with millions of Americans sharing their experiences and motivating others to join. This sense of community makes it easier to stay committed.

Tips to Succeed With a No-Spend Challenge

• Start small with a weekend or one week before committing to a month.

• Tell a friend or family member for accountability.

• Remove temptation by unsubscribing from store emails and deleting shopping apps.

• Use the saved money to build an emergency fund or start investing.

• Celebrate your success by tracking the total amount you saved.

Money saving challenges are more than just trends; they are practical financial tools that help Americans take control of their money. Among them, the no-spend challenge stands out as one of the top money saving challenges that actually work in the US.

If you want to improve your financial health, try a no spend week or month and see how much you can save. Combine it with other challenges like the 52-week plan or envelope challenge for even greater results.

Start your no spend challenge today your future self will thank you.

Many Americans are trying the no spend challenge to cut unnecessary expenses and improve their savings.https://www.investopedia.com/

Another article you can read in the Budget and Saving category.https://groviest.com/budget-reset-plan/