In today’s digital economy, you don’t need to be wealthy to start investing. With just $100 or even less you can take your first steps into the exciting world of digital assets. From cryptocurrencies and NFTs to tokenized stocks and DeFi tools, the opportunities are growing fast. If you’re curious how to get started without breaking the bank, this beginner-friendly guide is for you.

🧠 What Are Digital Assets?

Digital assets are electronic records that hold value. Unlike traditional investments like stocks or real estate, digital assets exist entirely online. Some popular examples include:

• Cryptocurrencies (like Bitcoin, Ethereum)

• NFTs (non-fungible tokens)

• Stablecoins

• Tokenized assets (digital representations of real-world assets)

• Digital real estate in metaverse platforms

These assets can be traded, transferred, and stored using blockchain technology, making them decentralized and secure.

💰 Is $100 Really Enough?

Yes! One of the greatest things about digital assets is accessibility. Unlike traditional real estate or stock investments, where you might need thousands of dollars, many digital assets are fractional. This means you can buy a small portion of a crypto coin or token.

Example:

• 1 Bitcoin = ~$60,000

• But you can buy 0.001 BTC for about $60

🛠️ Step-by-Step: How to Start Investing

- Choose a Reliable Crypto Exchange

To start, you’ll need a platform to buy digital assets. Some popular, beginner-friendly options in the U.S. include:

• Coinbase

• Kraken

• Gemini

• Binance US

Look for platforms with:

• Low fees

• Strong security features

• Easy-to-use interface

• Educational resources

- Set Up a Wallet (Optional but Recommended)

If you plan to hold your investments long-term, consider moving your assets to a non-custodial wallet. This gives you full control over your crypto.

Types of wallets:

• Hot Wallets (online): MetaMask, Trust Wallet

• Cold Wallets (offline): Ledger, Trezor

For beginners, hot wallets are easier to use, while cold wallets offer more security.

- Do Your Research

Never invest blindly. Learn the basics of blockchain, market trends, and the use case behind each asset. Check:

• Whitepapers (project documents)

• Roadmaps (future plans)

• Community support (Twitter, Reddit, Discord)

Start with trusted assets like:

• Bitcoin (BTC) – digital gold

• Ethereum (ETH) – smart contract leader

• Solana (SOL) – fast and scalable network

• Chainlink (LINK) – oracle-based asset

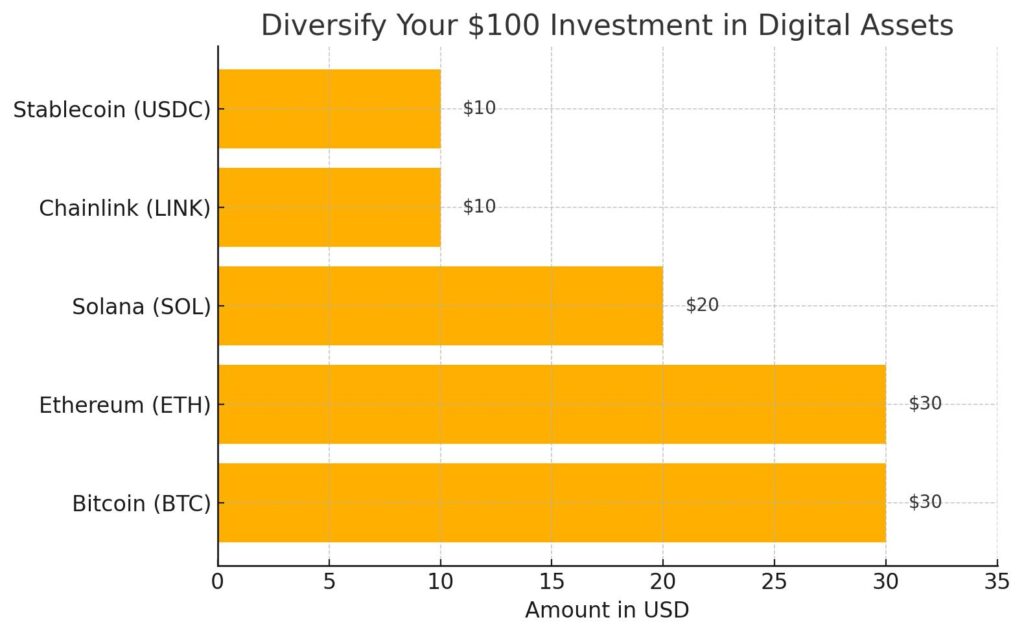

- Diversify Your $100

Don’t put all your funds into one asset. Here’s an example of how to spread $100:

- Start Small and Track Your Progress

Even if your first $100 doesn’t skyrocket, the experience itself is valuable. Use apps or spreadsheets to monitor your performance. Some tools to try:

• CoinMarketCap Watchlist

• Delta Investment Tracker

• Google Sheets templates

Consistency beats timing the market.

🔐 Tips for Staying Safe

• Always use two-factor authentication (2FA)

• Beware of phishing scams and fake apps

• Don’t trust anyone promising guaranteed returns

• Backup your wallet recovery phrases offline

🧩 Beyond Cryptocurrencies

If you’re feeling confident after investing in crypto, explore other digital assets like:

• NFTs – collectibles, art, music rights

• DeFi tokens – for lending, borrowing, and earning yield

• Tokenized stocks – digital shares of real companies

• Virtual land – plots in metaverses like Decentraland or The Sandbox

But always remember: more complexity = more risk. Grow slowly and smartly.

🚀 Final Thoughts

Starting your digital asset journey with $100 or less is not only possible—it’s a smart way to enter a rapidly evolving market. By educating yourself, starting small, and staying safe, you can build a strong foundation for future investments.

Whether you’re saving for the long term, building wealth, or just curious about crypto, this is your moment to start.

Disclaimer:

The content on Groviest.com is provided for informational purposes only and does not constitute financial, investment, legal, or tax advice. While we strive to provide accurate and up-to-date information, we make no guarantees of any kind regarding the completeness, accuracy, or applicability of the content.

Readers are encouraged to do their own research or consult with a licensed financial advisor before making financial decisions. Groviest.com and its authors are not responsible for any financial losses or decisions made based on the content of this blog.