Cryptocurrencies are no longer just about Bitcoin. In fact, Bitcoin now represents less than half of the total crypto market. The rest is made up of thousands of alternative cryptocurrencies—commonly known as altcoins. For U.S. investors, understanding altcoins is critical to building a diversified digital portfolio.

This guide will walk you through what altcoins are, how they work, the risks and benefits of investing in them, and which coins are most relevant to today’s U.S. crypto landscape.

🔹 What Are Altcoins?

Altcoins are simply “alternative coins” to Bitcoin. They include all cryptocurrencies that are not Bitcoin—from Ethereum and Solana to newer digital assets like PepeCoin or Aptos.

Some altcoins function as digital currency, while others serve unique purposes, such as powering smart contracts, enabling privacy, or facilitating cross-border payments.

🔹 Types of Altcoins

There are thousands of altcoins, but they generally fall into the following categories:

1. Smart Contract Platforms:

• Ethereum (ETH): The most well-known altcoin, it allows developers to build decentralized apps (dApps).

• Cardano (ADA), Solana (SOL): Ethereum competitors with faster transaction times.

2. Stablecoins:

• Pegged to traditional currencies like the U.S. dollar.

• Examples: Tether (USDT), USD Coin (USDC)

• Often used in crypto trading to avoid volatility.

3. Privacy Coins:

• Offer anonymous transactions.

• Examples: Monero (XMR), Zcash (ZEC)

4. Utility Tokens:

• Used within specific platforms or apps.

• Example: Chainlink (LINK) provides real-world data to smart contracts.

5. Governance Tokens:

• Allow users to vote on protocol decisions in decentralized finance (DeFi) systems.

• Example: Uniswap (UNI)

🔹 Why U.S. Investors Are Exploring Altcoins

While Bitcoin remains the most recognizable name in crypto, many U.S.-based investors are shifting focus toward altcoins for several reasons:

• 💰 Higher Growth Potential: Altcoins often experience higher price swings than Bitcoin, creating short-term and long-term profit opportunities.

• 🧠 Innovation: New features, such as faster transactions or scalable platforms, appeal to tech-savvy investors.

• 📉 Diversification: Owning multiple types of cryptocurrencies helps reduce risk in volatile markets.

• 💳 Utility: Many altcoins are actually used in day-to-day blockchain platforms or for DeFi applications.

According to reports from Coinbase and Kraken, altcoin trading volume among U.S. users has increased significantly since 2022.

🔹 How to Buy Altcoins in the U.S.

Most altcoins can be purchased on regulated exchanges such as:

• Coinbase Pro

• Binance US

• Kraken

To get started:

1. Sign up with a compliant crypto exchange.

2. Complete KYC (Know Your Customer) verification.

3. Fund your account using USD.

4. Buy altcoins via trading pairs (e.g., ETH/USD or SOL/USDC).

5. Transfer to a crypto wallet for long-term holding.

Note: Some altcoins may not be available in all U.S. states due to SEC regulations.

🔹 Risks of Altcoin Investing

While crypto investing in altcoins can be rewarding, there are significant risks U.S. investors should consider:

• ⚠️ Volatility: Prices can rise or fall by 20–50% in a single day.

• 🛑 Scams: Some altcoins are “pump and dump” schemes.

• ❌ Low Liquidity: Certain coins may be hard to sell at market price.

• ⚖️ Regulatory Uncertainty: The SEC is currently reviewing several tokens for classification as securities.

To minimize risk:

• Stick to well-known coins with real utility.

• Never invest more than you can afford to lose.

• Research each altcoin’s blockchain, team, and use case thoroughly.

🔹 Top 5 Altcoins Worth Exploring in 2025

While not financial advice, here are five altcoins U.S. investors are watching:

1. Ethereum (ETH) – Smart contract king.

2. Solana (SOL) – Fast transactions, strong ecosystem.

3. Polygon (MATIC) – Layer 2 solution for Ethereum.

4. Chainlink (LINK) – Leader in data feeds for DeFi.

5. Avalanche (AVAX) – Scalable blockchain for apps.

Each of these altcoins plays a major role in today’s digital asset economy.

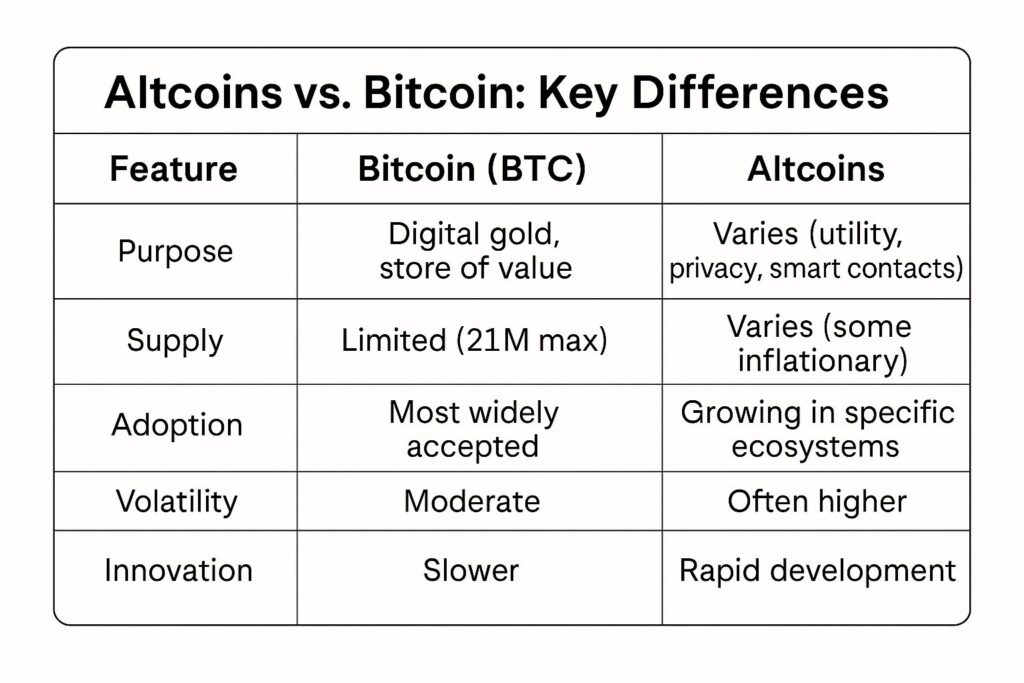

🔹 Altcoins vs. Bitcoin: Key Differences

Understanding the distinction helps U.S. investors balance their portfolios effectively.

🔹 Final Thoughts

Altcoins are not just “other coins”—they represent the next phase of innovation in the world of blockchain and digital assets. For American investors seeking more than just Bitcoin exposure, altcoins offer opportunities in DeFi, smart contracts, Web3, and beyond.

However, with great opportunity comes great risk. Take your time, stay informed, and consider starting with a small amount before scaling up.

Want to learn more about choosing the right altcoin? Stay tuned for our upcoming guide on how to analyze a cryptocurrency project before investing.

Disclaimer:

The content on Groviest.com is provided for informational purposes only and does not constitute financial, investment, legal, or tax advice. While we strive to provide accurate and up-to-date information, we make no guarantees of any kind regarding the completeness, accuracy, or applicability of the content.

Readers are encouraged to do their own research or consult with a licensed financial advisor before making financial decisions. Groviest.com and its authors are not responsible for any financial losses or decisions made based on the content of this blog.