When it comes to managing money, the line between being frugal and being cheap can sometimes appear thin. However, there is a significant difference between the two, and understanding that distinction can make or break your financial reputation and your ability to build long term wealth. In the conversation of frugal vs cheap, smart budgeters know that how you spend money is just as important as how much you save.

In this article, we will explore what it means to be frugal versus cheap, why one is financially and socially smarter than the other, and how you can make wise money decisions without sacrificing value, relationships, or your peace of mind.

What Does It Mean to Be Frugal ?

Being frugal means being intentional and efficient with your money. A frugal person seeks to maximize value in every purchase while minimizing waste. Frugality is not about denying yourself joy or essentials. Instead, it is about making thoughtful decisions and prioritizing long term financial health.

Frugal individuals are likely to:

• Compare prices before buying

• Use coupons or cashback offers

• Cook meals at home instead of dining out every night

• Choose quality items that last longer rather than the cheapest option available

Frugality involves a strategic mindset. It is rooted in value, not just price. A frugal person is willing to spend more upfront if it means saving money over time. For example, buying a durable pair of shoes that lasts three years instead of replacing a cheap pair every few months.

What Does It Mean to Be Cheap ?

Being cheap, on the other hand, is about spending the least amount of money possible, regardless of the consequences. Cheapness often ignores quality, time, and even relationships. A cheap person focuses only on the bottom line and avoids spending money at all costs even when spending could lead to better outcomes.

Cheap individuals are likely to:

• Buy the lowest priced items, even if they break quickly

• Avoid tipping service workers fairly

• Split hairs over a few dollars with friends

• Skip out on contributing to group expenses

Cheapness can damage reputations, create stress, and even lead to greater expenses in the long run due to poor quality purchases or missed opportunities. In the frugal vs cheap debate, cheapness may save you money today but cost you more in the future financially and emotionally.

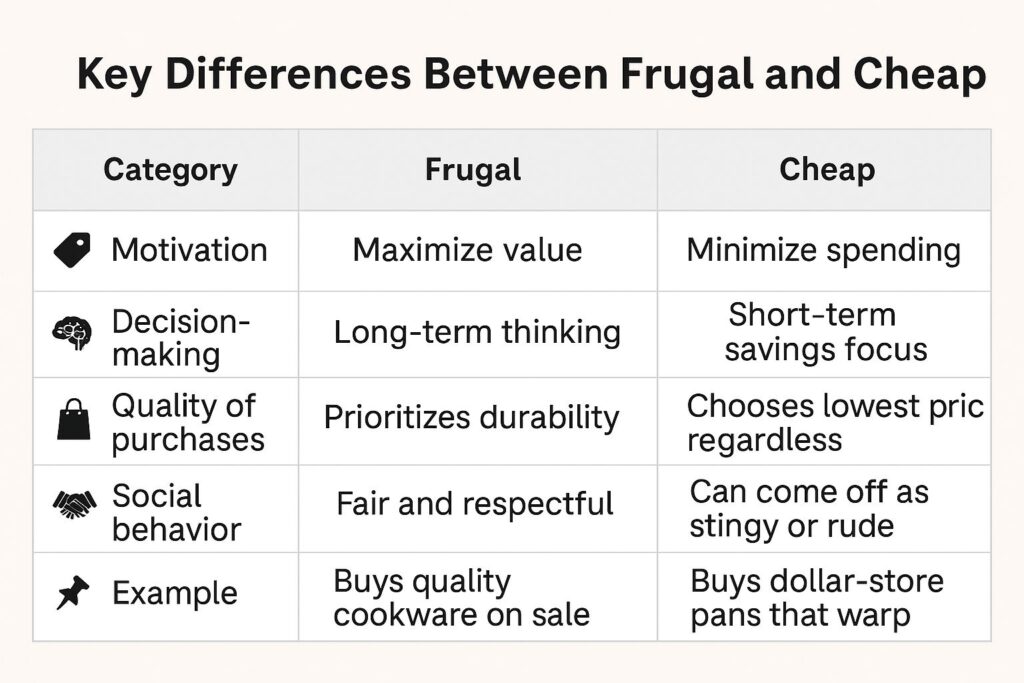

Understanding these key differences allows you to evaluate your own habits and adjust accordingly. Smart budgeters realize that financial discipline should never come at the cost of ethics or efficiency.

Why Frugal Is Smart and Cheap Is Risky

One of the most important financial lessons is that not all saving is wise saving. While saving money is good, doing so at the expense of quality or relationships can backfire.

Being frugal allows you to live within your means, reduce financial stress, and prepare for emergencies without isolating yourself or damaging your social life. It builds trust among peers and family, as you are seen as responsible and thoughtful.

Being cheap, however, often leads to:

• Low quality products that break and require replacement

• Missed opportunities for meaningful experiences

• Damaged personal and professional relationships

• A reputation for being difficult or selfish

The smart approach in the frugal vs cheap discussion is to value outcomes over just the price. What matters is not how little you spend, but how well you spend.

Examples in Everyday Life

Let’s explore real life scenarios that demonstrate the contrast between frugal and cheap behavior.

Buying Clothes

• Frugal: Buying high quality clothing during seasonal sales that lasts for years.

• Cheap: Buying extremely low cost clothes that shrink, rip, or fade after one wash.

Dining Out

• Frugal: Choosing affordable restaurants or using a coupon.

• Cheap: Avoiding tipping or arguing over splitting the bill.

Gift Giving

• Frugal: Creating a handmade or thoughtful low cost gift that has personal value.

• Cheap: Avoiding gift giving altogether or reusing old items as presents.

Home Repairs

• Frugal: Hiring a reputable handyman or learning to fix something properly yourself.

• Cheap: Ignoring needed repairs or using low grade tools that make the problem worse.

Every decision you make involving money tells a story. Choosing the frugal path can build a narrative of wisdom and respect, while being cheap may leave others questioning your priorities.

The Psychology Behind Frugality and Cheapness

Psychologists suggest that frugality is linked with self control, future planning, and emotional intelligence. Frugal people tend to evaluate long term consequences, leading to healthier financial behaviors.

Cheapness, however, is often tied to fear, scarcity mindset, or social anxiety. People who are cheap may feel deep insecurity about their finances or be overly focused on avoiding loss. Unfortunately, this mindset can cause even greater stress and poorer life quality in the long run.

In frugal vs cheap behavior patterns, one is driven by empowerment, the other by fear.

If you’re looking to tighten your budget without crossing the line into cheapness, here are some practical tips:

1. Focus on Value, Not Just Price

Ask yourself: Will this purchase last? Will it meet my needs long term?

2. Be Generous When It Matters

Tip service workers fairly, contribute to group events, and celebrate others’ milestones with sincerity.

3. Communicate Clearly

When budgeting with family or friends, explain your financial choices with transparency rather than avoidance.

4. Invest in Relationships

Spend on shared experiences that build connection. Frugal living does not mean isolation.

5. Plan Ahead

Emergency funds, holiday savings, and planned purchases reduce the pressure to make cheap decisions in a pinch.

6. Avoid Hoarding or Over Restricting

You can save money without denying yourself joy or safety. Balance is key.

7. Know Your Goals

Keep your financial goals in sight. Frugality supports progress. Cheapness stalls it.

By adopting these habits, you maintain your dignity, relationships, and financial progress all without overspending.

What Smart Budgeters Say About Frugal vs Cheap

Smart budgeters consistently advocate for frugality as a lifestyle. They understand that money is a tool, not a chain. Being frugal means using that tool wisely, cutting waste, and investing in what matters most.

Here’s what some real budget conscious individuals say:

• “I’d rather have one pair of great jeans than five that fall apart.”

• “Being frugal helped me pay off debt, but I never skipped birthdays or family dinners.”

• “Cheapness feels like fear. Frugality feels like control.”

These perspectives highlight how choosing wisely, rather than cheaply, leads to better emotional and financial outcomes.

Choose Frugal, Not Cheap

The battle of frugal vs cheap is not just a debate about money it is a reflection of values. Being frugal empowers you to make informed decisions, live well within your means, and build a sustainable future. Being cheap, in contrast, often leads to poor quality, missed experiences, and strained relationships.

Smart budgeters know the difference. They see frugality as a strength and cheapness as a weakness. You can save money, live well, and keep your integrity intact all at the same time.

So the next time you face a spending decision, ask yourself: Am I being frugal, or am I just being cheap ?

Another article you can read in the Budget and Saving category. https://groviest.com/budgeting-tips-lower-monthly-bills/

Investopedia – Frugal Definition

A clear financial definition of what it means to be frugal, including practical examples and mindset insights.