Hot vs Cold Wallets explained: Learn the key differences, pros, cons, and how to choose the best crypto storage option for your needs in 2025.

Introduction: Hot vs Cold Wallets – Why This Choice Matters

When it comes to storing cryptocurrency, the phrase Hot vs Cold Wallets comes up in almost every security discussion. Your wallet choice is more than just a convenience it can determine how safe your digital assets are. With billions of dollars in crypto stolen each year due to poor storage practices, understanding your options is essential. This guide will walk you through what hot and cold wallets are, how they work, and how to choose the right one for your needs.

What is a Hot Wallet?

A hot wallet is a cryptocurrency wallet connected to the internet. It allows you to send, receive, and store crypto conveniently. Examples include:

• Mobile wallets like Trust Wallet or MetaMask

• Web based wallets like Coinbase Wallet

• Desktop wallets such as Exodus

Because they are always online, hot wallets offer quick access to your funds. However, this constant internet connection also exposes them to hacking risks.

What is a Cold Wallet?

A cold wallet is a cryptocurrency wallet that is completely offline. These wallets store your private keys in a device or medium that does not connect to the internet. Examples include:

• Hardware wallets like Ledger Nano X or Trezor Model T

• Paper wallets stored securely

• Offline USB drives with encrypted data

Cold wallets are considered the gold standard for long term crypto storage because they are immune to online hacking attempts.

Hot Wallet Pros and Cons

Pros

• Instant access to your crypto anytime, anywhere

• Easy to send and receive funds

• Often free or low cost to set up

• Ideal for active traders who need speed

Cons

• Vulnerable to hacking, phishing, and malware attacks

• Security depends heavily on your device and network safety

• Requires regular updates to maintain security

Cold Wallet Pros and Cons

Pros

• Maximum security from online threats

• Great for long term holding of large amounts of crypto

• Immune to malware and phishing attacks

• You control your private keys completely

Cons

• Less convenient for quick transactions

• Requires physical access to the device to send funds

• Hardware wallets cost money (typically $50–$200)

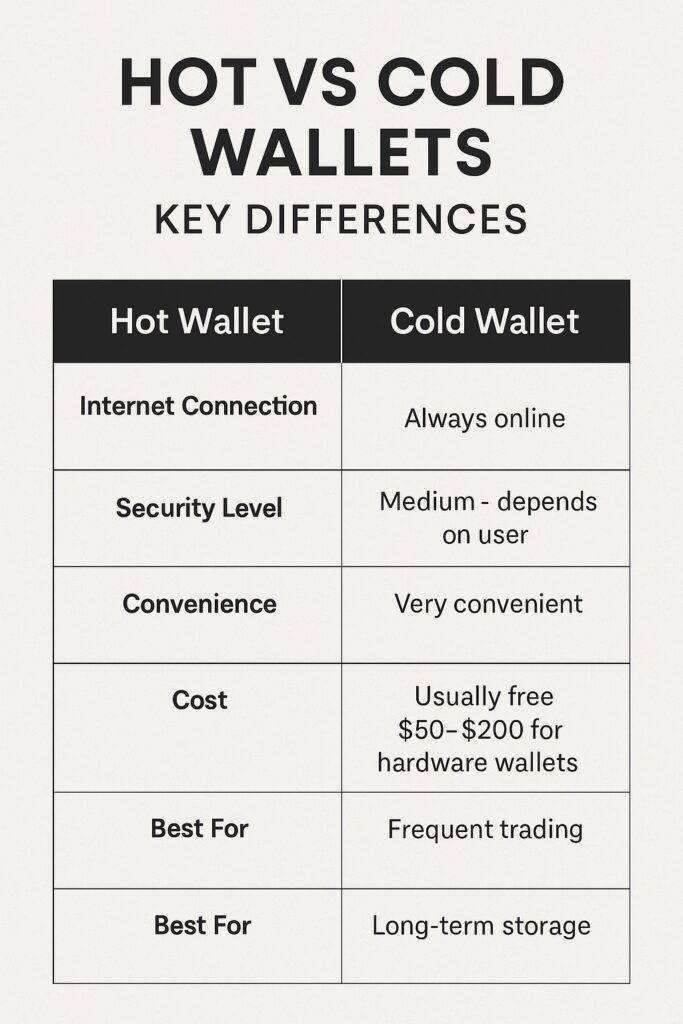

Hot vs Cold Wallets – Key Differences Table

Which Wallet Type is Best for You?

If you trade cryptocurrencies daily, a hot wallet offers the convenience you need. However, if you’re holding a large amount of crypto for months or years, a cold wallet provides unmatched security. Many experienced investors use both:

• Hot wallet for day to day transactions

• Cold wallet for long term holdings

Security Tips for Using Hot and Cold Wallets

1. For Hot Wallets: Enable two-factor authentication (2FA) and use strong, unique passwords.

2. For Cold Wallets: Store your hardware wallet in a safe place, and never share your recovery seed phrase.

3. Backup Your Keys: Whether hot or cold, always have a secure backup in case your device is lost or damaged.

4. Stay Updated: Keep your wallet software and firmware up to date to patch security vulnerabilities.

Final Thoughts on Hot vs Cold Wallets

When choosing between hot vs cold wallets, there’s no one size fits all answer. Your decision should depend on how often you trade, how much crypto you own, and your personal security preferences. For most investors, the smartest approach is to use a combination of both keeping small amounts in a hot wallet for easy access and the bulk of your assets in a cold wallet for maximum protection.

You can read another article in the Digital Assets category.https://groviest.com/earn-income-digital-assets/

Hot Wallet Examples: Mobile wallets like Coinbase Wallet offer quick access to your crypto anywhere, but they require strong security practices.

Cold Wallet Examples: Hardware wallets such as Ledger Nano X or Trezor Model T keep your private keys completely offline, providing maximum protection against online attacks.